Outline

- Introduction

- Brief overview of BCV (Banco Comercial Português)

- Importance of analyzing BCV stocks for investors

- Overview of BCV (Banco Comercial Português)

- Background information

- Ticker symbol and exchange

- Sector and industry classification

- Recent Performance and Analysis

- Stock performance

- Financial health

- Market sentiment

- Key Metrics to Watch

- Price-to-Earnings (P/E) Ratio

- Dividend Yield

- Earnings Per Share (EPS)

- Return on Equity (ROE)

- Investing Considerations

- Economic environment

- Regulatory changes

- Competitive landscape

- Resources for Information

- Financial news websites

- Official company website

- Stock market apps

- Conclusion

- Summary of key points

- Final thoughts on investing in BCV stocks

- Frequently Asked Questions (FAQs)

- Common queries about BCV stocks

- Detailed answers to help investors

Overview of BCV Stocks (Banco Comercial Português)

Banco Comercial Português (BCP)

- Ticker Symbol: BCP.LS

- Exchange: Euronext Lisbon

- Sector: Financial Services

- Industry: Banking

Recent Performance and Analysis

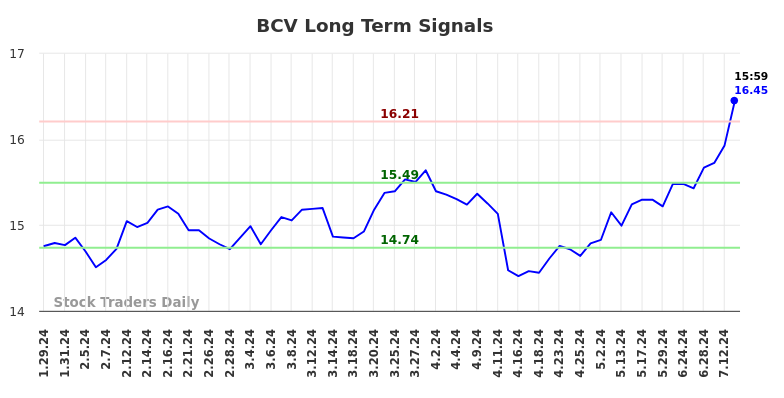

- Stock Performance: To get the latest stock price, historical performance, and other metrics, you can check financial news websites, stock market apps, or the official Euronext website.

- Financial Health: Look at the bank’s quarterly and annual reports to understand its revenue, profit margins, and other key financial metrics.

- Market Sentiment: Analyst ratings and market sentiment can provide insights into how BCV stocks are perceived in the market.

Key Metrics to Watch

- Price-to-Earnings (P/E) Ratio: This ratio helps in understanding the valuation of the stock compared to its earnings.

- Dividend Yield: If the bank pays dividends, the yield can be an important factor for income-focused investors.

- Earnings Per Share (EPS): A key indicator of the company’s profitability.

- Return on Equity (ROE): Indicates how effectively the company is using its equity to generate profit.

Investing Considerations

- Economic Environment: As a bank, BCV stocks performance is closely tied to the economic health of Portugal and the broader Eurozone.

- Regulatory Changes: Banking regulations in the EU can impact BCV’s operations and profitability.

- Competition: Consider the competitive landscape, including other major banks in Portugal and the Eurozone.

Resources for Information

- Financial News Websites: Websites like Bloomberg, Reuters, and MarketWatch provide up-to-date news and analysis.

- Official Company Website: BCP’s investor relations section will have the latest financial reports and press releases.

- Stock Market Apps: Apps like Yahoo Finance, Google Finance, and others provide real-time stock price updates and news.

Conclusion

In conclusion, BCV stocks(Banco Comercial Português) stocks present a notable opportunity for investors interested in the financial sector. By keeping an eye on key metrics such as the P/E ratio, dividend yield, EPS, and ROE, investors can make informed decisions. Additionally, understanding the economic environment, regulatory changes, and competitive landscape will provide further insights into the potential performance of BCV stocks. Utilizing resources like financial news websites, the official company website, and stock market apps can aid in staying updated with the latest information. As always, thorough research and careful consideration are essential when investing in stocks.

Frequently Asked Questions (FAQs)

1. What is the ticker symbol for BCV (Banco Comercial Português) stocks?

- The ticker symbol for BCV stocks is BCP.LS, and they are traded on the Euronext Lisbon exchange.

2. What sector and industry does BCV belong to?

- BCV belongs to the financial services sector and the banking industry.

3. How can I check the latest stock price for BCV?

- You can check the latest stock price on financial news websites, stock market apps, or the official Euronext website.

4. What are some key metrics to watch for BCV stocks?

- Key metrics include the Price-to-Earnings (P/E) Ratio, Dividend Yield, Earnings Per Share (EPS), and Return on Equity (ROE).

5. What factors should I consider when investing in BCV stocks?

- Consider the economic environment, regulatory changes, and competitive landscape in the banking sector.