Outline

- Introduction

- Brief overview of Cazoo

- Purpose of the article

- Company Overview

- Founding and background

- Services and market presence

- Stock Performance

- Recent trends and initial public offering

- Market challenges

- Financial Performance

- Revenue growth

- Profitability concerns

- Future Outlook

- Market expansion

- Technological advancements

- Economic factors

- Investment Considerations

- Long-term potential

- Risk factors

- Conclusion

- Summary of key points

- Final thoughts on investment prospects

Introduction

Cazoo stock, a prominent player in the online car retail industry, has garnered significant attention since its inception. The company aims to revolutionize the car-buying experience by allowing customers to purchase vehicles entirely online. Here’s a detailed look at Cazoo’s stock, its current status, and what the future might hold.

Company Overview

Founded in 2018 by Alex Chesterman, Cazoo operates in the UK and several European countries, offering a wide range of used cars for sale. The company promises a hassle-free buying experience with home delivery, a 7-day money-back guarantee, and comprehensive vehicle checks.

Stock Performance

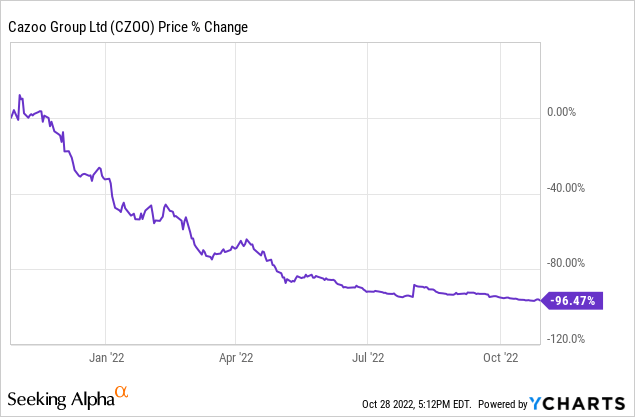

Recent Trends

Cazoo’s stock has experienced fluctuations since it went public via a SPAC merger in August 2021. Initially trading under the ticker symbol “CZOO” on the New York Stock Exchange, the stock saw a significant surge, reflecting investor optimism about the company’s disruptive business model and growth potential.

Market Challenges

Despite a strong debut, Cazoo’s stock has faced challenges due to broader market conditions and industry-specific issues. Supply chain disruptions, inflationary pressures, and increasing competition in the online car retail sector have impacted its stock performance. Investors have also been cautious due to concerns about the company’s profitability and long-term sustainability.

Financial Performance

Revenue Growth

Cazoo stock has reported impressive revenue growth, driven by increasing demand for online car purchases. The company’s ability to scale its operations and expand its market presence has been a key factor in its revenue trajectory.

Profitability Concerns

However, Cazoo is yet to achieve profitability. High operational costs, significant marketing expenditures, and investments in technology and infrastructure have contributed to ongoing losses. Investors are closely watching the company’s path to profitability, which will be crucial for long-term stock performance.

Future Outlook

Market Expansion

Cazoo’s expansion into European markets presents a significant growth opportunity. The company’s ability to penetrate new markets and establish a strong brand presence will be vital for future success. Strategic acquisitions and partnerships may also play a role in accelerating growth.

Technological Advancements

Investments in technology, such as AI-driven analytics and enhanced online platforms, could improve operational efficiency and customer experience. These advancements may help Cazoo gain a competitive edge and drive higher sales volumes.

Economic Factors

Macroeconomic factors, such as interest rates, consumer confidence, and regulatory changes, will also influence Cazoo’s stock performance. The company’s resilience in navigating economic challenges will be critical for maintaining investor confidence.

Investment Considerations

Long-Term Potential

For long-term investors, Cazoo’s innovative business model and growth potential make it an intriguing investment opportunity. The company’s ability to disrupt the traditional car retail market and capture a significant share of the online segment could yield substantial returns over time.

Risk Factors

However, potential investors should be aware of the risks associated with investing in Cazoo. Market volatility, competitive pressures, and the company’s current lack of profitability are key considerations. Conducting thorough research and staying informed about industry trends and company developments is essential for making informed investment decisions.

Conclusion

Cazoo stock represents both an exciting opportunity and a considerable risk. The company’s innovative approach to car retailing and ambitious growth plans have the potential to transform the industry. However, investors must carefully weigh the challenges and uncertainties that lie ahead. As Cazoo continues to navigate its growth journey, its stock performance will be closely watched by market participants seeking to capitalize on the evolving online car retail market.

FAQs

Q1: When did Cazoo go public?

- A1: Cazoo went public in August 2021 through a SPAC merger.

Q2: What is Cazoo’s stock ticker symbol?

- A2: Cazoo’s stock is traded under the ticker symbol “CZOO” on the New York Stock Exchange.

Q3: What services does Cazoo offer?

- A3: Cazoo offers online car retail services, including home delivery, a 7-day money-back guarantee, and comprehensive vehicle checks.

Q4: What are the main challenges Cazoo’s stock has faced?

- A4: Cazoo’s stock has faced challenges due to supply chain disruptions, inflationary pressures, and increasing competition in the online car retail sector.

Q5: Is Cazoo profitable?

- A5: No, Cazoo is not yet profitable. High operational costs and significant investments have contributed to ongoing losses.