Outline

An Introduction to Leveraged ETFs

- H2: What is FNGU?

- H3: Overview of Leveraged ETFs

- H3: Purpose

How Works

- H3: The Mechanism Behind Leveraged ETFs

- H3: Daily Rebalancing Explained

- H3: FNGU’s Strategy: 3x Exposure to Technology Stocks

The Technology Giants

- H3: Facebook (Meta Platforms)

- H3: Apple

- H3: Netflix

- H3: Google (Alphabet)

- H3: Amazon

Advantages of Investing

- H3: Potential for High Returns

- H3: Exposure to Leading Tech Companies

- H3: Daily Compounding Benefits

Risks and Considerations

- H3: Volatility in Leveraged ETFs

- H3: The Impact of Market Downturns

- H3: Understanding Time Decay in FNGU

Who Should Invest?

- H3: The Ideal Investor Profile

- H3: Long-Term vs. Short-Term Investment Goals

How to Invest

- H3: Accessing FNGU on the Stock Market

- H3: Important Considerations Before Buying

Tax Implications

- H3: Understanding Taxation on Leveraged ETFs

- H3: How FNGU Affects Your Tax Strategy

Comparing with Other Leveraged ETFs

- H3: FNGU vs. TQQQ

- H3: FNGU vs. SOXL

Common Misconceptions

- H3: Addressing the Risks

- H3: Clarifying Daily Rebalancing

Historical Performance

- H3: How FNGU Has Performed Over the Years

- H3: Key Events Impacting FNGU’s Performance

Future Prospects

- H3: The Growth of Technology Stocks

- H3: Potential Challenges Ahead

FAQs

Introduction

Leveraged ETFs, like FNGU, are financial instruments designed to amplify the returns of an underlying index or asset class. FNGU, specifically, provides a way for investors to gain triple (3x) the daily returns of an index focused on some of the biggest names in technology. But what exactly is , and how does it work? Let’s dive into the details.

What is FNGU?

Overview of Leveraged ETFs

Leveraged Exchange-Traded Funds (ETFs) are complex financial products that use derivatives and debt to boost the returns of an underlying index. They are not your typical buy-and-hold investments. Instead, they are designed for short-term trades, often held for a single day to maximize the daily movements of the underlying assets.

The Purpose

The MicroSectors FANG+ Index 3X Leveraged ETN, is designed to provide investors with 3x the daily performance of the NYSE FANG+ Index. This index includes a group of highly popular technology and tech-enabled companies, which are major players in the digital economy.

How Works

The Mechanism Behind Leveraged ETFs

Leveraged ETFs like achieve their amplified returns through the use of financial derivatives such as swaps and futures contracts. By leveraging the value of these contracts, the fund can offer a magnified return, which in the case , is three times the daily performance of the FANG+ Index.

Daily Rebalancing Explained

A critical aspect of design is daily rebalancing. This process resets the fund’s leverage ratio at the end of each trading day. While this ensures that the fund consistently provides 3x the daily return, it also means that holding for extended periods can lead to significant deviations from the expected return due to the effects of compounding.

FNGU’s Strategy: 3x Exposure to Technology Stocks

Strategy revolves around providing investors with substantial exposure to leading technology stocks. This means that if the FANG+ Index rises by 1% in a day, It is designed to rise by 3%. However, the inverse is also true, making a high-risk, high-reward investment.

The Technology Giants

It performance is heavily tied to the companies that make up the FANG+ Index. Here’s a closer look at these tech giants:

Facebook (Meta Platforms)

As a leader in social media and digital advertising, Facebook (now Meta Platforms) is a crucial component of the FANG+ Index. Its performance directly influences the returns of FNGU.

Apple

Apple’s innovation in consumer electronics, software, and services has made it one of the most valuable companies in the world. Its stock performance plays a significant role in the value.

Netflix

Netflix, as a pioneer in streaming media, holds a key position in the FANG+ Index. Its ability to attract and retain subscribers affects overall performance.

Google (Alphabet)

Google’s dominance in search and advertising, combined with its ventures into cloud computing and artificial intelligence, makes it a heavyweight in the FANG+ Index, impacting significantly.

Amazon

Amazon’s e-commerce empire and cloud services are major drivers of its stock value. Its performance is crucial to returns.

Advantages of Investing

Investing in offers several potential benefits, especially for those looking to capitalize on short-term market movements.

Potential for High Returns

One of the most attractive aspects of is its potential for high returns. By leveraging the daily performance of top technology stocks, It can deliver substantial gains, especially in a bullish market.

Exposure to Leading Tech Companies

It provides exposure to some of the most influential and fastest-growing technology companies in the world. This can be an appealing prospect for investors looking to tap into the tech sector’s growth.

Daily Compounding Benefits

For those who understand how to use it, daily compounding can be a powerful tool. If the underlying index experiences consecutive positive days, It can significantly magnify these gains.

Risks and Considerations

While the potential for high returns is alluring, It is not without its risks. Understanding these risks is crucial for any potential investor.

Volatility in Leveraged ETFs

Leveraged ETFs like FNGU are inherently volatile. The use of leverage means that price swings are magnified, leading to larger gains but also larger losses.

The Impact of Market Downturns

In a declining market, FNGU losses can be severe. The same leverage that boosts returns in a rising market will also amplify losses, making it essential to approach FNGU with caution during bearish periods.

Understanding Time Decay

Over time, the daily rebalancing and compounding can lead to what’s known as time decay. This means that even if the underlying index returns to its original level, Its value may not fully recover, especially if there’s been significant volatility.

Who Should Invest?

FNGU is not for everyone. It’s a specialized investment tool that’s best suited for certain types of investors.

The Ideal Investor Profile

The ideal FNGU investor is someone with a high-risk tolerance who actively monitors the market. It’s not recommended for passive investors or those with a low tolerance for risk.

Long-Term vs. Short-Term Investment Goals

FNGU is primarily designed for short-term trading rather than long-term investing. Those who plan to hold their investments over an extended period might want to reconsider using FNGU due to the potential for time decay.

How to Invest

If you’ve decided that FNGU aligns with your investment strategy, here’s how you can get started.

Accessing FNGU on the Stock Market

FNGU is traded on the stock market, just like any other ETF. Investors can buy and sell FNGU through their brokerage accounts during market hours.

Important Considerations Before Buying

Before buying FNGU, consider your overall portfolio strategy, risk tolerance, and the current market conditions. It’s also wise to set stop-loss orders to protect against unexpected market downturns.

Tax Implications

Understanding the tax implications of FNGU is crucial for managing your investment’s profitability.

Understanding Taxation on Leveraged ETFs

Leveraged ETFs are taxed like regular ETFs, but the frequent trading and daily rebalancing can lead to short-term capital gains, which are taxed at a higher rate than long-term gains.

How FNGU Affects Your Tax Strategy

Because of its structure, FNGU may generate more taxable events than other types of investments. It’s essential to work with a tax advisor to optimize your tax strategy when investing in FNGU.

Comparing FNGU with Other Leveraged ETFs

There are other leveraged ETFs similar to FNGU. Here’s how FNGU compares to some of them:

FNGU vs. TQQQ

Both FNGU and TQQQ offer 3x leverage, but while FNGU focuses on the FANG+ Index, TQQQ is based on the Nasdaq-100. Depending on your focus, one may be more suitable than the other.

FNGU vs. SOXL

SOXL offers 3x leverage on the semiconductor sector, which is another key area in technology. Comparing these ETFs can help you decide where you want to focus your investments.

Common Misconceptions About FNGU

There are several misconceptions about FNGU that need to be addressed.

Addressing the Risks

Many investors underestimate the risks associated with leveraged ETFs. It’s important to understand that while the potential for high returns exists, so does the potential for significant losses.

Clarifying Daily Rebalancing

Some investors believe that holding FNGU over the long term will yield 3x the return of the FANG+ Index. However, due to daily rebalancing, this is not accurate, especially in volatile markets.

Historical Performance of FNGU

Looking at the past performance of FNGU can provide insights into its potential future behavior.

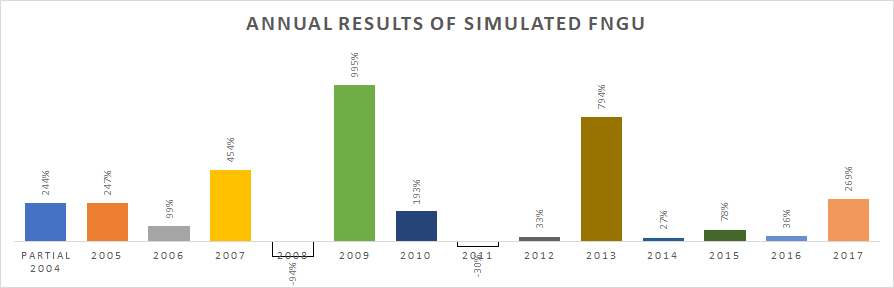

How FNGU Has Performed Over the Years

FNGU has seen periods of substantial growth, particularly during tech booms, but has also experienced sharp declines during market corrections.

Key Events Impacting FNGU’s Performance

Events such as earnings reports, changes in technology regulation, and macroeconomic factors have all played a role in shaping FNGU’s performance over time.

Future Prospects

What does the future hold for FNGU? While no one can predict the market with certainty, certain trends can offer clues.

The Growth of Technology Stocks

If technology stocks continue their upward trajectory, FNGU stands to benefit significantly. However, investors should remain cautious of potential market corrections.

Potential Challenges Ahead

Challenges such as regulatory changes, market saturation, and economic downturns could pose risks to FNGU future performance.

FAQs

What makes different from other ETFs?

FNGU offers 3x leverage on the FANG+ Index, providing amplified exposure to major technology companies.

Is suitable for beginners?

Due to its complexity and high risk, FNGU is generally not recommend for beginners.

Can be held long-term?

FNGU is designed for short-term trading, and holding it long-term may lead to time decay and unexpect results.

How does handle dividends?

FNGU does not directly pay dividends. Instead, the value of dividends is factored into the index’s total return.

What happens if one of the underlying companies in performs poorly?

If one of the companies in the FANG+ Index performs poorly, it can negatively impact FNGU’s overall return, especially given the leverage.