Outline

- Introduction

- What is GLSI Stock?

- Importance of Understanding Stock Investments

- Company Overview

- History of Greenwich LifeSciences (GLSI)

- Key Products and Services

- Market Position and Competitors

- Stock Market Basics

- What is the Stock Market?

- How Stock Trading Works

- Importance of Stock Analysis

- Performance

- Historical Performance

- Recent Trends and Patterns

- Key Metrics to Watch

- Factors Influencing

- Market Sentiment

- Company News and Announcements

- Industry Trends

- Economic Indicators

- Investment Strategies

- Long-Term vs. Short-Term Investment

- Fundamental Analysis

- Technical Analysis

- Risks and Challenges

- Market Volatility

- Company-Specific Risks

- Regulatory and Compliance Issues

- How to Buy

- Choosing a Brokerage

- Steps to Purchase

- Tips for New Investors

- Potential for Growth

- Upcoming Projects and Innovations

- Analyst Predictions

- Future Market Opportunities

- Dividends and Earnings

- Dividend Policy

- Earnings Reports and Their Impact

- Comparing GLSI to Other Biotech Stocks

- Key Competitors

- Comparative Performance

- Expert Opinions

- Analyst Ratings

- Market Sentiment Analysis

- Investor Resources

- Where to Find Reliable Information

- Recommended Tools and Platforms

- FAQs

- Common Questions About GLSI Stock

- Practical Tips for Investors

- Conclusion

- Summary of Key Points

- Final Thoughts on Investing in GLSI Stock

Introduction

Investing in stocks can be a rewarding venture, but it requires a solid understanding of the market and the companies within it. One such company is Greenwich LifeSciences (GLSI), a promising player in the biotech industry. In this comprehensive guide, we will delve into the intricacies of GLSI stock, its performance, factors influencing its value, and strategies for investing.

Company Overview

History of Greenwich LifeSciences (GLSI)

Greenwich LifeSciences, founded in 2006, is a biopharmaceutical company dedicated to developing novel cancer immunotherapies. The company has made significant strides in its field, with its flagship product, GP2, aimed at preventing the recurrence of breast cancer.

Key Products and Services

The primary focus of GLSI is on GP2, an immunotherapy designed to stimulate the immune system to target and destroy residual cancer cells. This innovative approach has the potential to transform cancer treatment and improve patient outcomes significantly.

Market Position and Competitors

GLSI operates in the competitive biotech sector, facing rivals such as Moderna, Pfizer, and BioNTech. Despite the competition, GLSI’s unique focus on cancer immunotherapy sets it apart and positions it for potential growth.

Stock Market Basics

What is the Stock Market?

The stock market is a platform where investors buy and sell shares of publicly traded companies. It plays a crucial role in the economy by providing companies with access to capital and investors with opportunities to grow their wealth.

How Stock Trading Works

Stock trading involves buying shares at a certain price with the hope of selling them at a higher price in the future. Prices fluctuate based on supply and demand, company performance, and broader market trends.

Importance of Stock Analysis

Analyzing stocks involves evaluating a company’s financial health, market position, and growth potential. This helps investors make informed decisions and minimize risks.

GLSI Stock Performance

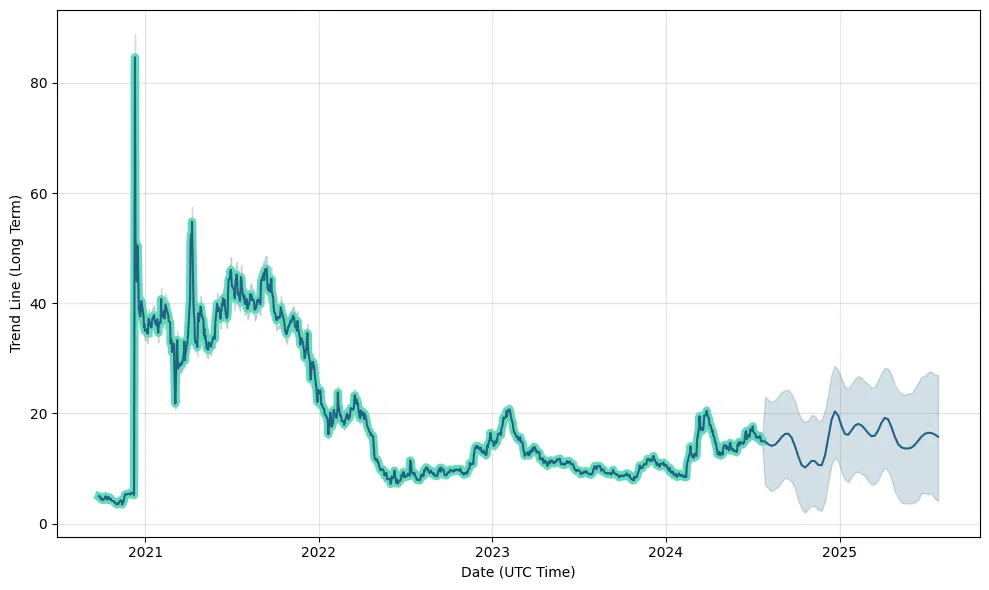

Historical Performance

GLSI stock has shown significant volatility since its initial public offering (IPO). Understanding its historical performance can provide insights into its potential future trajectory.

Recent Trends and Patterns

Recently, GLSI stock has experienced fluctuations due to various factors, including clinical trial results, regulatory approvals, and market sentiment. Keeping an eye on these trends is essential for investors.

Key Metrics to Watch

Key metrics to consider when evaluating GLSI stock include its price-to-earnings (P/E) ratio, earnings per share (EPS), and market capitalization. These indicators help assess the company’s financial health and growth potential.

Factors Influencing GLSI Stock

Market Sentiment

Investor sentiment plays a significant role in stock prices. Positive news, such as successful clinical trials, can drive the stock price up, while negative news can have the opposite effect.

Company News and Announcements

Announcements related to clinical trial results, regulatory approvals, and partnerships can significantly impact GLSI stock. Staying updated on company news is crucial for investors.

Industry Trends

The biotech industry is influenced by advancements in technology, regulatory changes, and market demand. Understanding these trends can help predict the performance of GLSI stock.

Economic Indicators

Broader economic indicators, such as interest rates, inflation, and economic growth, also affect stock prices. These factors can influence investor confidence and market stability.

Investment Strategies for GLSI Stock

Long-Term vs. Short-Term Investment

Deciding whether to invest in GLSI stock for the long term or short term depends on your financial goals and risk tolerance. Long-term investments often involve less risk and can yield substantial returns over time.

Fundamental Analysis

Fundamental analysis involves evaluating the company’s financial statements, management team, and market position to determine its intrinsic value. This approach helps identify undervalued stocks with growth potential.

Technical Analysis

Technical analysis focuses on studying historical price patterns and trading volumes to predict future price movements. This method is useful for identifying entry and exit points for trades.

Risks and Challenges

Market Volatility

Stock prices can be highly volatile, especially in the biotech sector. Market fluctuations can result in significant gains or losses, making it essential for investors to stay informed and manage risks effectively.

Company-Specific Risks

Investing in GLSI stock comes with specific risks, including clinical trial failures, regulatory hurdles, and competition from other biotech firms. Understanding these risks is crucial for making informed investment decisions.

Regulatory and Compliance Issues

Biotech companies like GLSI must navigate complex regulatory environments. Delays in approvals or changes in regulations can impact the company’s operations and stock performance.

How to Buy GLSI Stock

Choosing a Brokerage

To buy GLSI stock, you’ll need to open an account with a brokerage firm. Consider factors such as fees, trading platforms, and customer support when choosing a brokerage.

Steps to Purchase

- Open a brokerage account.

- Deposit funds into your account.

- Search for GLSI stock using its ticker symbol.

- Decide on the number of shares to buy.

- Place your order.

Tips for New Investors

- Start with a small investment to minimize risk.

- Diversify your portfolio to spread risk.

- Stay informed about market trends and company news.

Potential for Growth

Upcoming Projects and Innovations

GLSI has several projects in the pipeline, including expanding the use of GP2 for other types of cancer. These innovations could drive future growth and increase the stock’s value.

Analyst Predictions

Analysts’ predictions can provide insights into the potential performance of GLSI stock. Positive analyst ratings can boost investor confidence and drive the stock price higher.

Future Market Opportunities

The demand for effective cancer treatments continues to grow, presenting significant market opportunities for GLSI. The company’s focus on immunotherapy positions it well to capitalize on these opportunities.

Dividends and Earnings

Dividend Policy

GLSI does not currently pay dividends, as it reinvests earnings into research and development. This strategy supports long-term growth and innovation.

Earnings Reports and Their Impact

Earnings reports provide a snapshot of the company’s financial health. Positive earnings can boost investor confidence and drive the stock price up, while negative earnings can have the opposite effect.

Comparing GLSI to Other Biotech Stocks

Key Competitors

GLSI competes with several other biotech firms, including Moderna, Pfizer, and BioNTech. Comparing these companies can provide insights into GLSI’s market position and growth potential.

Comparative Performance

Analyzing the performance of GLSI stock relative to its competitors can help investors make informed decisions. Consider factors such as market capitalization, revenue growth, and product pipelines.

Expert Opinions on GLSI Stock

Analyst Ratings

Analyst ratings can provide valuable insights into the potential performance of GLSI stock. Look for ratings from reputable analysts and consider their recommendations when making investment decisions.

Market Sentiment Analysis

Market sentiment analysis involves evaluating the overall mood of investors towards GLSI stock. Positive sentiment can drive the stock price higher, while negative sentiment can result in declines.

Investor Resources

Where to Find Reliable Information

Reliable information is crucial for making informed investment decisions. Look for news from reputable financial news sources, company press releases, and regulatory filings.

Recommended Tools and Platforms

Several tools and platforms can help investors stay informed and make better decisions. Consider using stock analysis tools, financial news apps, and investment forums to stay updated.

FAQs

Common Questions About GLSI Stock

- What is GLSI stock?

- GLSI stock represents shares of Greenwich LifeSciences, a biopharmaceutical company focused on cancer immunotherapy.

- How can I buy GLSI stock?

- You can buy GLSI stock through a brokerage account. Follow the steps outlined in this guide to make your purchase.

- Is GLSI a good investment?

- Investing in GLSI stock carries risks and potential rewards. Conduct thorough research and consider your financial goals before investing.

- What factors influence GLSI stock price?

- Factors include market sentiment, company news, industry trends, and economic indicators.

- Where can I find information about GLSI stock?

- Reliable sources include financial news websites, company press releases, and regulatory filings.

Conclusion

Investing in GLSI stock offers both opportunities and challenges. By understanding the company’s history, market position, and factors influencing its stock price, investors can make informed decisions. Whether you’re a seasoned investor or new to the stock market, this comprehensive guide provides the insights needed to navigate the complexities of investing in GLSI stock.