Outline

- Introduction

- Brief overview of Kering and its significance in the market

- Importance of understanding share prices

- What is Kering?

- History and background

- Key brands under Kering

- Kering’s Market Position

- Market capitalization and global standing

- Competitors in the luxury goods industry

- Factors Influencing Kering’s Share Price

- Economic indicators

- Industry trends

- Company performance and earnings reports

- Recent Trends in Kering’s Share Price

- Overview of recent performance

- Key events impacting share price

- How to Analyze Kering’s Share Price

- Fundamental analysis

- Technical analysis

- Kering’s Financial Health

- Revenue and profit margins

- Debt and liquidity ratios

- Impact of Global Events on Kering’s Share Price

- COVID-19 pandemic

- Trade policies and tariffs

- Investment Strategies for Kering Shares

- Long-term vs. short-term investments

- Diversification and risk management

- Kering’s Dividend Policy

- Dividend history

- Future dividend expectations

- Expert Opinions on Kering’s Share Price

- Analyst ratings and recommendations

- Market sentiment

- Comparing Kering with Competitors

- Performance against other luxury brands

- Market share analysis

- Future Outlook for Kering

- Growth opportunities

- Potential challenges

- Conclusion

- Summary of key points

- Final thoughts on investing in Kering

- FAQs

- What is the current share price of Kering?

- How often does Kering pay dividends?

- What are the risks associated with investing in Kering?

- How has Kering’s share price performed historically?

- Where can I buy Kering shares?

Introduction

If you’re an investor or just someone interested in the luxury goods market, understanding the share price of Kering is crucial. Kering share price, a major player in the luxury sector, has a significant influence on the market. Knowing what drives its share price can help you make informed investment decisions.

What is Kering?

History and Background

Kering, a French-based multinational corporation, is a powerhouse in the luxury goods industry. Founded in 1963 by François Pinault, Kering has evolved from a timber trading company to one of the most prestigious luxury conglomerates in the world.

Key Brands Under Kering

Kering boasts a portfolio of iconic brands, including Gucci, Saint Laurent, Bottega Veneta, and Balenciaga. Each of these brands contributes to Kering’s overall market performance and appeal.

Kering’s Market Position

Market Capitalization and Global Standing

Kering’s market capitalization is a testament to its strong position in the luxury sector. It consistently ranks among the top luxury brands globally, thanks to its high-quality products and strong brand equity.

Competitors in the Luxury Goods Industry

Kering faces stiff competition from other luxury giants like LVMH, Richemont, and Hermès. Understanding its position relative to these competitors provides insight into its market dynamics.

Factors Influencing Kering’s Share Price

Economic Indicators

Kering’s share price is sensitive to various economic indicators such as inflation rates, currency exchange rates, and economic growth. A robust economy often boosts consumer spending on luxury goods, positively impacting Kering’s share price.

Industry Trends

Trends in the luxury goods industry, such as shifts in consumer preferences and technological advancements, also play a significant role. Staying ahead of these trends is vital for Kering’s continued success.

Company Performance and Earnings Reports

Kering’s quarterly and annual earnings reports provide a snapshot of its financial health and operational performance. Positive earnings reports typically lead to an increase in share price, while negative reports can cause declines.

Recent Trends in Kering’s Share Price

Overview of Recent Performance

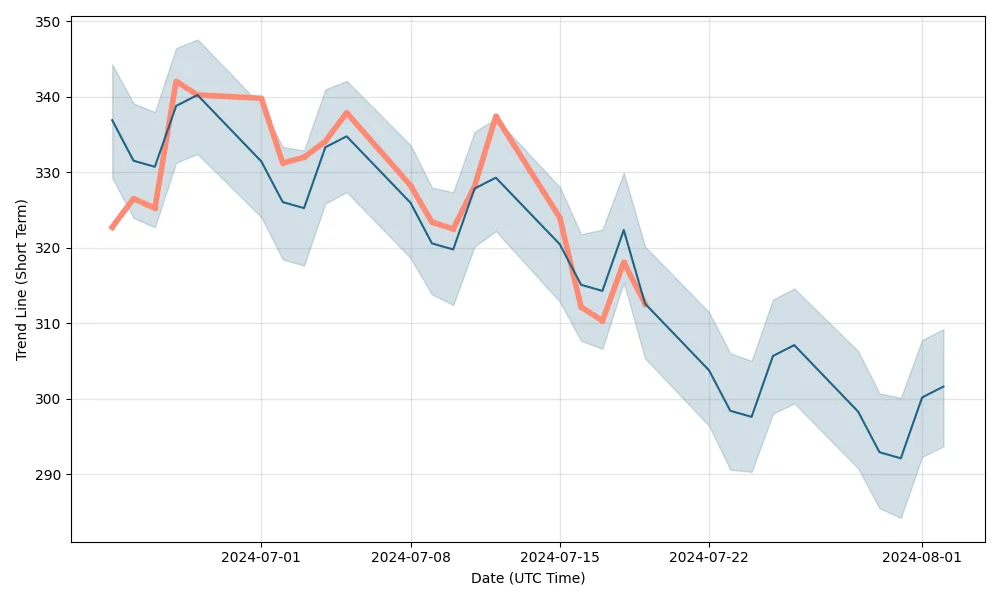

Analyzing recent trends in Kering’s share price helps identify patterns and potential future movements. Factors such as seasonal sales, new product launches, and market sentiment can all influence recent performance.

Key Events Impacting Share Price

Significant events, such as acquisitions, strategic partnerships, or changes in executive leadership, can have immediate impacts on Kering share price. For instance, the appointment of a new CEO or the acquisition of a rival brand can boost investor confidence.

How to Analyze Kering’s Share Price

Fundamental Analysis

Fundamental analysis involves evaluating Kering’s financial statements, management quality, and competitive advantages. This approach helps determine the intrinsic value of the company and its shares.

Technical Analysis

Technical analysis focuses on historical price and volume data to predict future price movements. Using tools like moving averages and trend lines, investors can identify potential buy or sell signals.

Kering’s Financial Health

Revenue and Profit Margins

Kering’s revenue growth and profit margins are key indicators of its financial health. Strong revenue and healthy profit margins suggest efficient operations and market demand for its products.

Debt and Liquidity Ratios

Assessing Kering’s debt levels and liquidity ratios helps determine its ability to meet short-term obligations. A high debt-to-equity ratio might indicate financial leverage, while a strong current ratio signifies good liquidity.

Impact of Global Events on Kering’s Share Price

COVID-19 Pandemic

The COVID-19 pandemic had a profound impact on the luxury goods market, including Kering. The lockdowns and economic uncertainty led to decreased consumer spending, affecting Kering’s share price.

Trade Policies and Tariffs

Changes in trade policies and tariffs can affect Kering’s supply chain and cost structure. For example, tariffs on imported goods can increase costs, potentially impacting profitability and share price.

Investment Strategies for Kering Shares

Long-term vs. Short-term Investments

Investors need to decide whether to hold Kering shares for the long term or trade them for short-term gains. Long-term investments benefit from the company’s growth potential, while short-term trading can capitalize on price volatility.

Diversification and Risk Management

Diversifying your portfolio with Kering shares can spread risk and enhance returns. Combining Kering with other stocks from different sectors helps mitigate potential losses.

Kering’s Dividend Policy

Dividend History

Kering has a history of paying dividends to its shareholders, reflecting its profitability and commitment to returning value. Analyzing past dividend payments provides insights into future expectations.

Future Dividend Expectations

Investors often look at the dividend payout ratio and company earnings to gauge future dividend payments. A sustainable payout ratio indicates a company’s ability to maintain or increase dividends.

Expert Opinions on Kering’s Share Price

Analyst Ratings and Recommendations

Financial analysts provide ratings and recommendations based on their research. These ratings, ranging from “buy” to “sell,” influence investor decisions and can impact share price.

Market Sentiment

Market sentiment, driven by news, rumors, and overall economic conditions, also affects Kering’s share price. Positive sentiment can drive up prices, while negative sentiment can lead to declines.

Comparing Kering with Competitors

Performance Against Other Luxury Brands

Comparing Kering’s financial performance and market share with competitors like LVMH and Hermès helps assess its competitive position. Metrics such as revenue growth, profit margins, and market share are key indicators.

Market Share Analysis

Kering’s market share in the luxury goods industry reflects its dominance and competitiveness. Analyzing market share trends can reveal shifts in consumer preferences and competitive dynamics.

Future Outlook for Kering

Growth Opportunities

Kering has several growth opportunities, including expanding into new markets, launching new products, and leveraging digital technologies. These opportunities can drive future revenue and share price growth.

Potential Challenges

However, Kering also faces challenges such as changing consumer preferences, economic uncertainty, and competitive pressures. Addressing these challenges is crucial for sustained growth.

Conclusion

Understanding Kering share price involves analyzing various factors, from economic indicators to company performance. By staying informed and applying the right investment strategies, investors can make sound decisions regarding Kering shares.

FAQs

What is the current share price of Kering?

The current share price of Kering fluctuates based on market conditions. For the latest price, check financial news websites or stock market apps.

How often does Kering pay dividends?

Kering typically pays dividends annually. However, the exact frequency and amount can vary based on the company’s financial performance and board decisions.

What are the risks associated with investing in Kering?

Investing in Kering carries risks such as market volatility, economic downturns, and competitive pressures. It’s important to assess these risks before investing.