Outline

- Introduction

- Brief overview of Kuehne Nagel share price

- Importance of share price in investment decisions

- Current Share Price

- Latest share price data

- Comparison with 52-week high and low

- Market performance and trends

- Factors Influencing Share Price

- Recent financial performance and results

- Market conditions and economic factors

- Company-specific news and developments

- Investment Considerations

- P/E ratio and market capitalization

- Dividend yield and payout

- Analyst opinions and forecasts

- Conclusion

- Summary of key points

- Future outlook for Kuehne + Nagel

- FAQs

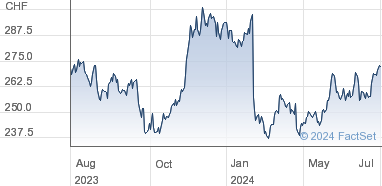

Kuehne Nagel share price, a leading global logistics company, has recently seen its share price trading at CHF 274.10. This price represents a notable 9.21% decline from its 52-week high of CHF 301.90 achieved in January 2024. The share price has fluctuated within a range of CHF 234.50 to CHF 301.90 over the past year. The company’s financial health, recent half-yearly results, and market dynamics play significant roles in shaping its stock performance. Investors closely monitor these factors, along with broader economic conditions, to make informed decisions about their investments in Kuehne + Nagel.

Conclusion

In conclusion, Kuehne Nagel share price current share price reflects both the company’s recent financial performance and the prevailing market conditions. While the stock is trading below its 52-week high, it remains a key player in the logistics industry with robust financial metrics. Investors should consider various factors, including the P/E ratio, dividend yield, and broader economic trends, when evaluating the stock’s potential. As the company continues to navigate the complexities of the global market, its future outlook remains a topic of interest for stakeholders.

FAQs

What is the current share price?

The current share price of Kuehne + Nagel is CHF 274.10.

How has the share price performed over the past year?

The share price has ranged from CHF 234.50 to CHF 301.90 over the past year, with a 52-week high of CHF 301.90 reached in January 2024.

What factors are influencing the share price of Kuehne + Nagel?

Factors influencing the share price include the company’s financial performance, recent results, market conditions, and company-specific news such as strategic initiatives and market expansions.

Is Kuehne + Nagel a good investment?

Investment decisions should be based on a thorough analysis of the company’s financial health, market position, P/E ratio, dividend yield, and broader economic conditions. Consulting analyst opinions and forecasts can also provide valuable insights.