Outline:

- Introduction

- Brief overview of KWEB stock

- Importance of understanding KWEB for investors

- What is KWEB Stock?

- Definition and background

- The company behind KWEB

- The Importance of Investing in Chinese Technology

- Growth of the Chinese tech sector

- Potential benefits and risks

- KWEB Stock Performance

- Historical performance

- Recent trends and data

- Key Holdings in KWEB

- Top companies in KWEB’s portfolio

- Sector breakdown

- Market Factors Affecting KWEB

- Economic factors

- Political and regulatory factors

- Comparison with Other Tech ETFs

- How KWEB stacks up against other tech-focused ETFs

- Unique aspects of KWEB

- How to Invest in KWEB Stock

- Steps to buying KWEB

- Considerations for new investors

- Risks Associated with KWEB

- Market volatility

- Regulatory risks

- Potential for Future Growth

- Predictions and expert opinions

- Factors that could drive growth

- KWEB Dividends and Yield

- Dividend policies

- Yield comparison with other ETFs

- KWEB vs. Direct Investment in Chinese Stocks

- Pros and cons of KWEB vs. individual Chinese stocks

- Diversification benefits

- Analyzing KWEB with Technical Indicators

- Popular technical indicators

- How to interpret them for KWEB

- Investor Sentiment and KWEB

- Current investor sentiment

- How sentiment affects KWEB’s performance

- Conclusion

- Summary of key points

- Final thoughts on investing in KWEB

- FAQs

- What is the expense ratio of KWEB?

- How often does KWEB pay dividends?

- Can I invest in KWEB through my retirement account?

- What are the alternatives to KWEB?

- How can I stay updated on KWEB’s performance?

Introduction

Investing in the stock market can be a daunting task, especially when it involves international markets. One such intriguing investment is the KWEB stock, an ETF that focuses on Chinese technology companies. This guide aims to demystify KWEB stock, providing you with the insights you need to make informed investment decisions.

What is KWEB Stock?

KWEB, or the KraneShares CSI China Internet ETF, is an exchange-traded fund that tracks the performance of the CSI Overseas China Internet Index. This ETF provides investors with exposure to publicly traded Chinese internet companies. KWEB was launched by KraneShares, a company known for its focus on China-focused exchange-traded funds.

The Importance of Investing in Chinese Technology

China’s technology sector has been booming over the past decade. As the world’s second-largest economy, China’s tech companies are at the forefront of innovation and growth. Investing in Chinese technology through KWEB offers potential benefits such as high growth rates and diversification. However, it also comes with risks, including regulatory challenges and market volatility.

KWEB Stock Performance

Understanding the historical performance of KWEB is crucial for investors. Since its inception, KWEB has seen significant growth, reflecting the rapid expansion of China’s tech sector. Recent trends indicate continued interest in Chinese internet companies, despite occasional fluctuations due to geopolitical and economic factors.

Key Holdings in KWEB

KWEB’s portfolio includes some of the most prominent Chinese tech giants. Companies like Alibaba, Tencent, and JD.com are among its top holdings. These companies are leaders in e-commerce, social media, and cloud computing, making KWEB a diverse and robust ETF.

Market Factors Affecting KWEB

Several factors can influence the performance of KWEB stock. Economic conditions in China, such as GDP growth and consumer spending, play a significant role. Additionally, political and regulatory factors, including government policies and international trade relations, can impact the ETF’s performance.

Comparison with Other Tech ETFs

When comparing KWEB to other tech-focused ETFs, it stands out due to its exclusive focus on Chinese internet companies. While other tech ETFs may offer broader global exposure, KWEB provides a concentrated investment in a high-growth market, appealing to investors looking for targeted exposure.

How to Invest in KWEB Stock

Investing in KWEB is straightforward. You can purchase shares through any brokerage account that offers ETFs. For new investors, it’s essential to consider factors like the expense ratio, potential returns, and your risk tolerance before buying KWEB.

Risks Associated with KWEB

Investing in KWEB is not without risks. Market volatility can lead to significant price swings, and regulatory risks are always a concern with Chinese investments. It’s crucial to weigh these risks against the potential rewards when considering KWEB for your portfolio.

Potential for Future Growth

The future looks promising for KWEB, with experts predicting continued growth in China’s tech sector. Factors such as increased internet penetration, technological advancements, and supportive government policies could drive further growth in KWEB’s holdings.

KWEB Dividends and Yield

KWEB has a dividend policy, but its primary appeal lies in capital appreciation rather than yield. The ETF’s yield may not be as high as other income-focused investments, but it offers growth potential through its underlying tech stocks.

KWEB vs. Direct Investment in Chinese Stocks

Investing directly in Chinese stocks can be challenging due to market accessibility and regulatory issues. KWEB offers a simpler alternative, providing diversified exposure to Chinese internet companies without the complexities of direct investment.

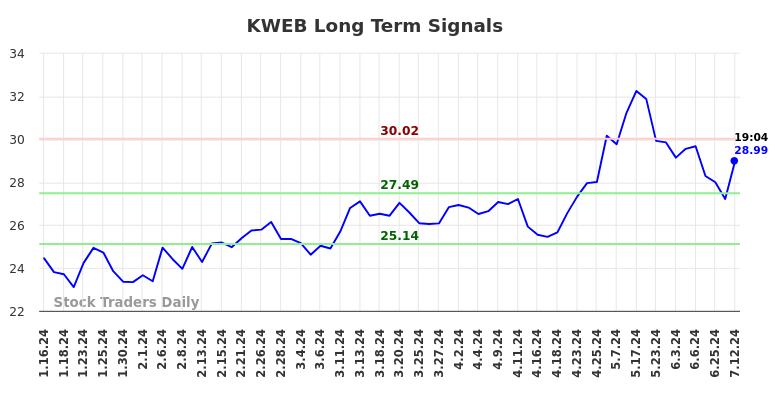

Analyzing KWEB with Technical Indicators

For investors who prefer technical analysis, KWEB can be analyzed using various indicators such as moving averages, RSI, and MACD. These tools can help identify trends and potential entry or exit points.

Investor Sentiment and KWEB

Investor sentiment plays a significant role in KWEB’s performance. Currently, sentiment towards Chinese tech stocks is cautiously optimistic, reflecting both the growth potential and the inherent risks.

Conclusion

In summary, KWEB stock offers a unique opportunity to invest in China’s burgeoning tech sector. While it comes with risks, the potential rewards make it a compelling option for growth-oriented investors. By understanding the factors that influence KWEB and staying informed, you can make well-informed investment decisions.

FAQs

- What is the expense ratio of KWEB?

- The expense ratio of KWEB is approximately 0.76%, which is competitive for a specialized ETF focusing on Chinese internet companies.

- How often does KWEB pay dividends?

- KWEB typically pays dividends annually. However, the focus of the ETF is more on capital growth rather than income generation.

- Can I invest in KWEB through my retirement account?

- Yes, you can invest in KWEB through various retirement accounts, including IRAs and 401(k) plans, as long as your brokerage offers it.

- What are the alternatives to KWEB?

- Alternatives to KWEB include other tech-focused ETFs like QQQ, which focuses on the NASDAQ-100, and FXI, which targets broader Chinese stocks.

- How can I stay updated on KWEB’s performance?

- To stay updated on KWEB’s performance, you can follow financial news websites, use stock tracking apps, and subscribe to updates from KraneShares.