Outline

- Introduction

- What is Nijisanji?

- Importance of virtual talent agencies

- History of Nijisanji

- Founding and early years

- Growth and expansion

- Nijisanji’s Business Model

- Revenue streams

- Key partnerships and collaborations

- Stock Market Basics

- Understanding stock investments

- How virtual companies fit in

- Nijisanji’s Market Presence

- Current market standing

- Key competitors

- Financial Performance

- Revenue growth

- Profit margins

- Stock Performance Analysis

- Historical stock performance

- Current stock trends

- Factors Influencing Nijisanji’s Stock

- Market trends

- Company-specific factors

- Investment Potential

- Why invest in Nijisanji?

- Risks and considerations

- Nijisanji’s Future Outlook

- Predicted market trends

- Strategic initiatives

- Expert Opinions

- Analyst ratings

- Industry expert insights

- How to Invest in Nijisanji Stock

- Steps to buy Nijisanji stock

- Recommended platforms

- Case Studies

- Successful investments in virtual companies

- Lessons learned

- Conclusion

- Summary of key points

- Final thoughts

- FAQs

- What is Nijisanji?

- How has Nijisanji grown over the years?

- What factors influence Nijisanji’s stock?

- Is investing in Nijisanji stock risky?

- How can I invest in Nijisanji stock?

Introduction

In the ever-evolving world of entertainment, virtual talent agencies like Nijisanji stock have carved a niche for themselves. These agencies manage virtual YouTubers (VTubers), who entertain millions globally. With the rise of digital platforms, understanding the stock of such companies has become essential for investors.

History of Nijisanji

Nijisanji, founded in 2018 by Ichikara Inc., quickly became a pioneer in the VTuber industry. Starting with a few talents, it now boasts over 100 virtual personalities. Their engaging content and innovative approach have driven significant growth and expansion.

Nijisanji’s Business Model

Nijisanji operates on a diverse revenue model. They earn from:

- Merchandise Sales: Branded goods like apparel, accessories, and more.

- Super Chats: Donations made by fans during live streams.

- Sponsorships: Collaborations with brands for promotions and advertisements.

- Events: Virtual and real-world events featuring their talents.

Partnerships with platforms like YouTube and Twitch have further solidified their presence.

Stock Market Basics

Investing in stocks involves buying shares of a company, thus owning a part of it. Stocks of virtual companies like Nijisanji offer unique opportunities due to their digital nature and global reach.

Nijisanji’s Market Presence

Nijisanji stands out in the VTuber industry. They compete with agencies like Hololive and VShojo but maintain a unique identity through diverse content and a vast roster of talents.

Financial Performance

Nijisanji’s financial performance has shown robust growth. Their revenue has consistently increased, driven by expanding fanbase and diversified income streams. Profit margins have also improved, reflecting effective cost management and strategic investments.

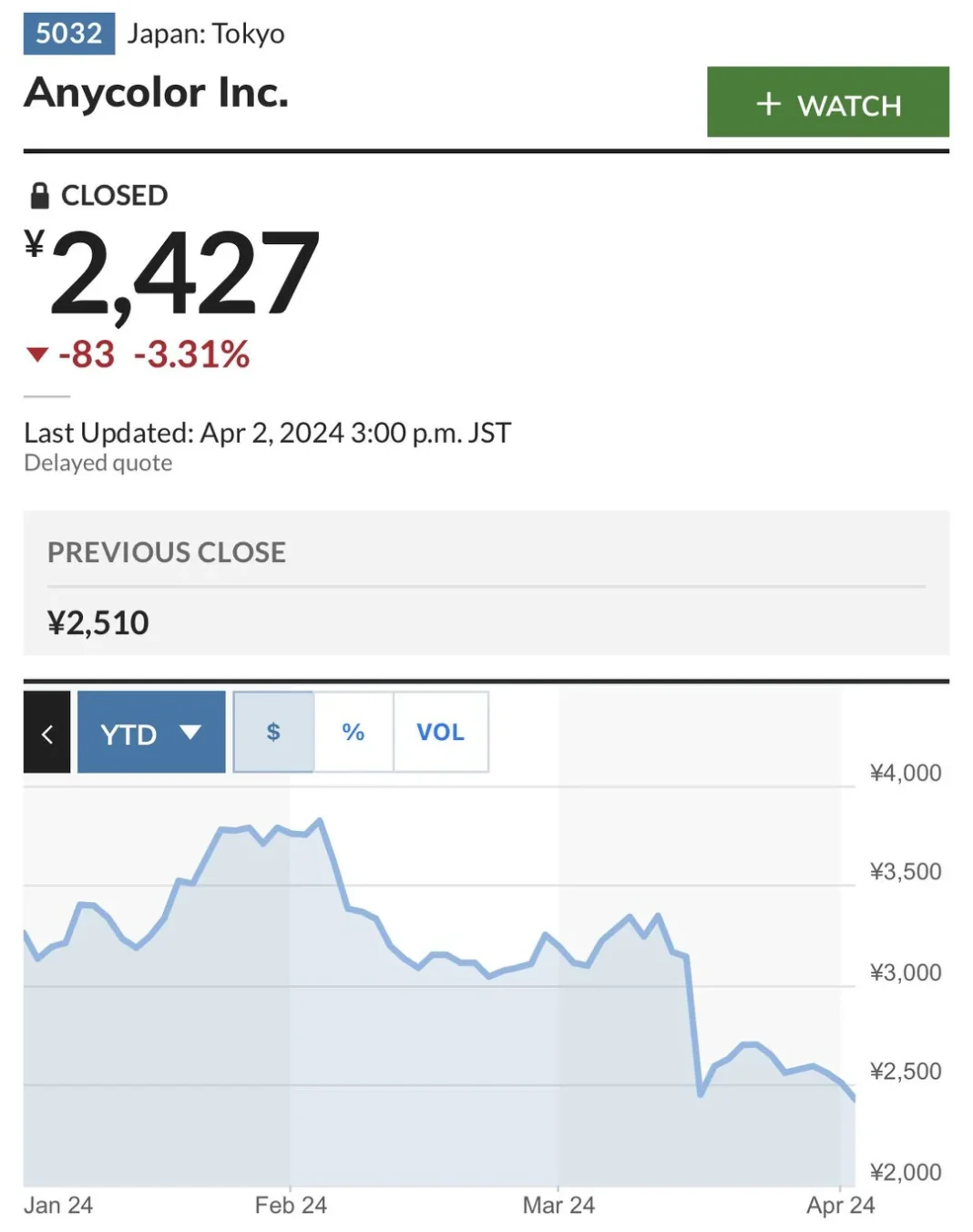

Stock Performance Analysis

Historically, Nijisanji stock has shown positive trends. Initial volatility was common, but the stock has stabilized, showing steady growth. Current trends indicate a strong market position, with potential for further appreciation.

Factors Influencing Nijisanji’s Stock

Several factors influence Nijisanji’s stock:

- Market Trends: The growing popularity of VTubers boosts stock value.

- Company-Specific Factors: New talent debuts, partnerships, and innovative content drive growth.

- Global Reach: Expansion into international markets increases revenue potential.

Investment Potential

Investing in Nijisanji offers several advantages:

- Growing Industry: The VTuber industry is expanding, presenting growth opportunities.

- Strong Brand: Nijisanji’s strong brand and loyal fanbase ensure stable revenue.

- Diversified Income: Multiple revenue streams reduce risk.

However, potential investors should consider market competition and regulatory changes as risks.

Nijisanji’s Future Outlook

The future looks promising for Nijisanji. Predicted market trends show continued growth in digital entertainment. Strategic initiatives, like expanding their talent roster and enhancing global presence, will likely drive future success.

Expert Opinions

Analysts and industry experts hold positive views on Nijisanji’s stock. Ratings generally suggest a “buy” due to the company’s strong market position and growth potential. Expert insights highlight the innovative business model and robust fan engagement as key strengths.

How to Invest in Nijisanji Stock

To invest in Nijisanji stock:

- Choose a Brokerage: Select a platform that offers Nijisanji stock.

- Open an Account: Complete the registration process.

- Deposit Funds: Add money to your account.

- Buy Shares: Search for Nijisanji stock and place an order.

Recommended platforms include Robinhood, E*TRADE, and TD Ameritrade.

Case Studies

Successful investments in virtual companies highlight key lessons:

- Early Investment: Investing early in emerging industries can yield high returns.

- Diversification: Spreading investments across multiple virtual companies reduces risk.

Conclusion

Nijisanji stock represents a unique investment opportunity in the burgeoning VTuber industry. With a solid business model, growing market presence, and promising future, Nijisanji’s stock holds potential for investors seeking growth in digital entertainment.

FAQs

What is Nijisanji? Nijisanji is a virtual talent agency managing virtual YouTubers (VTubers) who entertain through live streaming and video content.

How has Nijisanji grown over the years? Since its founding in 2018, Nijisanji has expanded its talent roster and revenue streams, establishing a strong market presence.

What factors influence Nijisanji’s stock? Market trends, company-specific developments, and global expansion efforts influence Nijisanji’s stock performance.

Is investing in Nijisanji stock risky? While there are risks, such as market competition and regulatory changes, Nijisanji’s strong brand and diversified revenue reduce overall risk.

How can I invest in Nijisanji stock? Choose a brokerage platform, open an account, deposit funds, and buy Nijisanji shares.