Outline

1. Introduction

- Brief overview of Organigram Holdings Inc. (OGI)

- Importance of understanding stock details for potential investors

2. Company Background

- Company name and ticker symbol

- Market listings (Nasdaq, TSX)

- Industry and primary business operations

3. Business Operations

- Description of products (dried flower, pre-rolls, oils, vaporizers, edibles)

- Location of operations (Moncton, New Brunswick, Canada)

- Innovative cultivation methods

4. Financial Performance

- Overview of revenue trends

- Earnings and profitability challenges

- Market capitalization insights

5. Recent Developments

- Expansion efforts and new product lines

- Strategic partnerships

- Impact of regulatory changes

6. Stock Performance

- Factors influencing stock performance (market sentiment, legislation, earnings reports)

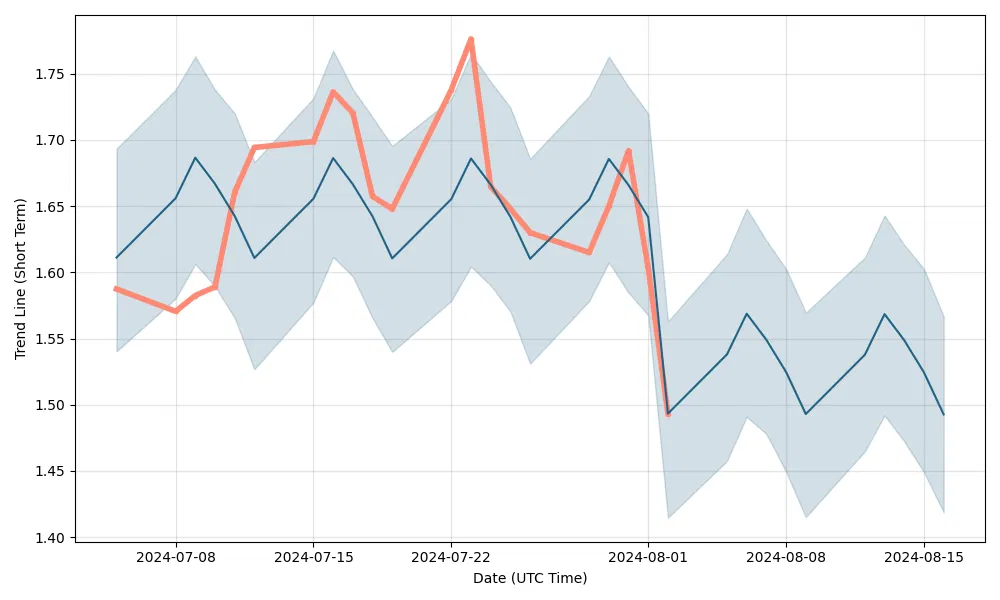

- Historical stock price trends

- Analysis of recent stock movements

7. Investment Considerations

- Volatility and risk factors

- Growth potential in the cannabis industry

- Key risks (regulatory, competition, operational challenges)

8. Conclusion

- Summary of key points

- Final thoughts on investing in OGI stock

9. FAQs

- Common questions about OGI stock

- Detailed answers for potential investors

FAQs

Q1: What is the ticker symbol for Organigram Holdings Inc.? A1: The ticker symbol for Organigram Holdings Inc. is OGI. It is listed on both the Nasdaq and the Toronto Stock Exchange.

Q2: What products does Organigram Holdings Inc. produce? A2: Organigram produces a variety of cannabis products, including dried flower, pre-rolls, oils, vaporizers, and edibles such as chocolates and gummies.

Q3: Where is Organigram Holdings Inc. located? A3: Organigram’s primary operations are based in Moncton, New Brunswick, Canada.

Q4: How has OGI’s financial performance been recently? A4: Organigram’s financial performance has experienced fluctuations due to market conditions and regulatory changes. The company has faced challenges in achieving consistent profitability.

Q5: What recent developments have impacted OGI stock? A5: Recent developments include the company’s efforts to expand its product lines, strategic partnerships, and regulatory changes in the cannabis industry.