Outline

- Introduction

- Overview of SMA Solar Technology AG

- Importance of investing in renewable energy stocks

- What is SMA Solar Technology AG?

- Company history

- Key products and services

- The Solar Energy Market

- Current state of the solar energy industry

- Future growth projections

- Market Position

- Competitive advantages

- Market share analysis

- Financial Performance

- Recent financial results

- Key financial metrics

- Stock Performance Overview

- Historical stock performance

- Recent trends and movements

- Factors Influencing

- Technological advancements

- Government policies and regulations

- Market demand for solar energy

- SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

- Investment Strategies

- Long-term investment potential

- Short-term trading opportunities

- Risks Associated with Investing

- Market volatility

- Industry-specific risks

- Comparison with Other Solar Stocks

- Key competitors

- Comparative analysis

- Analyst Ratings and Future Outlook

- Current analyst ratings

- Future stock price predictions

- Environmental Impact and Corporate Responsibility

- SMA Solar’s sustainability initiatives

- Impact on the environment

- How to Invest

- Steps to buy the stock

- Recommended platforms and brokers

- Conclusion

- Summary of key points

- Final thoughts

- FAQs

Introduction

Investing in renewable energy is not just a trend; it’s a smart move for the future. One company that’s been making waves in this sector is SMA Solar Stock. In this article, we’ll dive deep into everything you need to know about SMA Solar stock, from the company’s background to its financial performance and future outlook. If you’re considering investing in solar energy, this comprehensive guide will provide you with valuable insights.

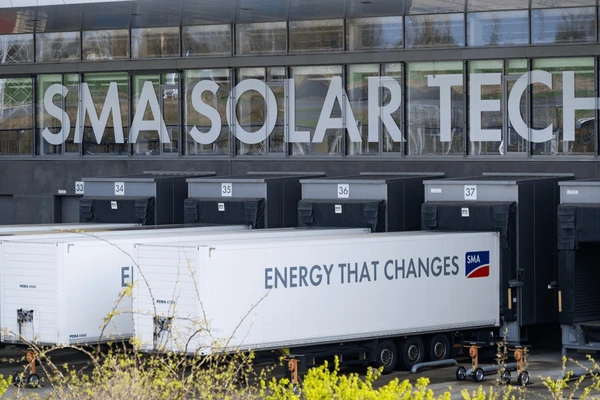

What is SMA Solar Technology AG?

SMA Solar Technology AG, a German company, has been a pioneer in the solar energy sector since its inception. Founded in 1981, the company specializes in the development, production, and sales of solar inverters and innovative energy management solutions. These products are essential for converting solar energy into usable electricity, making them a critical component of solar power systems worldwide.

The Solar Energy Market

The solar energy market has seen exponential growth over the past decade. With increasing awareness of climate change and a global push towards renewable energy, the demand for solar power continues to rise. According to industry projections, the solar energy market is expected to grow significantly in the coming years, driven by technological advancements and supportive government policies.

SMA Solar’s Market Position

SMA Solar holds a strong position in the global solar market. The company’s competitive advantages include its extensive experience, robust product portfolio, and a strong focus on research and development. SMA Solar’s market share is significant, and it continues to expand its footprint in key markets around the world.

Financial Performance

Understanding a company’s financial performance is crucial for any investor. SMA Solar has consistently demonstrated solid financial results. Recent financial reports indicate steady revenue growth, healthy profit margins, and a strong balance sheet. Key financial metrics such as earnings per share (EPS) and return on equity (ROE) are also favorable, making SMA Solar an attractive investment.

Stock Performance Overview

SMA Solar stock has shown impressive performance over the years. Historical stock data reveals a pattern of growth, with notable increases during periods of heightened market demand for renewable energy. Recently, the stock has experienced some fluctuations, but overall, it remains a strong contender in the renewable energy sector.

Factors Influencing SMA Solar Stock

Several factors can influence the performance of SMA Solar stock:

- Technological Advancements: Innovations in solar technology can drive demand for SMA Solar’s products.

- Government Policies and Regulations: Supportive policies can boost the solar industry, while unfavorable regulations can pose challenges.

- Market Demand for Solar Energy: The overall demand for solar energy directly impacts SMA Solar’s sales and stock performance.

SWOT Analysis

Conducting a SWOT analysis helps in understanding the company’s strengths, weaknesses, opportunities, and threats:

- Strengths: Strong brand reputation, extensive product range, global presence.

- Weaknesses: High dependency on specific markets, exposure to raw material price fluctuations.

- Opportunities: Expansion into emerging markets, increasing adoption of renewable energy.

- Threats: Intense competition, regulatory changes, economic downturns.

Investment Strategies for SMA Solar Stock

Investors can adopt various strategies when it comes to SMA Solar stock:

- Long-term Investment Potential: Given the growing demand for renewable energy, SMA Solar stock has strong long-term growth potential.

- Short-term Trading Opportunities: For those looking to capitalize on market volatility, SMA Solar stock offers ample short-term trading opportunities.

Risks Associated with Investing in SMA Solar Stock

As with any investment, there are risks involved:

- Market Volatility: Stock prices can be highly volatile, influenced by market trends and external factors.

- Industry-specific Risks: Changes in government policies, technological advancements, and competition can impact the solar industry.

Comparison with Other Solar Stocks

When considering an investment in SMA Solar, it’s essential to compare it with other solar stocks:

- Key Competitors: Companies like First Solar, Enphase Energy, and SolarEdge Technologies are major players in the solar industry.

- Comparative Analysis: Analyzing financial performance, market position, and growth potential can help determine which stock offers the best investment opportunity.

Analyst Ratings and Future Outlook

Analyst ratings provide valuable insights into a stock’s potential:

- Current Analyst Ratings: Most analysts have a positive outlook on SMA Solar stock, with several rating it as a “buy.”

- Future Stock Price Predictions: Based on market trends and company performance, analysts predict a favorable future for SMA Solar stock.

Environmental Impact and Corporate Responsibility

SMA Solar is committed to sustainability and reducing its environmental footprint:

- Sustainability Initiatives: The company invests in eco-friendly technologies and practices.

- Impact on the Environment: SMA Solar’s products contribute to reducing carbon emissions and promoting clean energy.

How to Invest in SMA Solar Stock

Investing in SMA Solar stock is straightforward:

- Steps to Buy the Stock: Research the stock, choose a broker, and place your order.

- Recommended Platforms and Brokers: Popular platforms like E*TRADE, TD Ameritrade, and Robinhood are excellent choices for purchasing SMA Solar stock.

Conclusion

Investing in SMA Solar stock offers a unique opportunity to be part of the growing renewable energy sector. With a strong market position, solid financial performance, and a commitment to sustainability, SMA Solar is well-positioned for future growth. As always, it’s important to conduct thorough research and consider your investment goals before making any decisions.

FAQs

What is SMA Solar Technology AG known for?

SMA Solar is known for its innovative solar inverters and energy management solutions, essential for converting solar power into usable electricity.

How has SMA Solar performed financially in recent years?

SMA Solar has shown solid financial performance with steady revenue growth, healthy profit margins, and strong key financial metrics.

What are the main risks of investing in SMA Solar stock?

Risks include market volatility, industry-specific challenges, and potential changes in government policies and regulations.

How does SMA Solar compare to other solar energy companies?

SMA Solar holds a competitive position with a strong brand reputation, extensive product range, and a global presence. A comparative analysis with key competitors can provide further insights.

Where can I buy SMA Solar stock?

You can buy SMA Solar stock through popular platforms like E*TRADE, TD Ameritrade, and Robinhood.