The SXXP index, also known as the STOXX Europe 600 Index, is a key benchmark for the European equity market. It includes 600 of the largest companies across 17 European countries, providing a comprehensive overview of the European stock market. Here are the key aspects of the SXXP index:

Overview

The STOXX Europe 600 Index represents large, mid, and small-cap companies across various sectors. It covers companies from Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

Composition

The index is designed to provide a broad representation of the European economy, including companies from diverse industries such as technology, healthcare, financial services, consumer goods, and industrials. The inclusion criteria are based on market capitalization and liquidity.

Calculation

The SXXP index is weighted by market capitalization, which means that companies with higher market values have a greater impact on the index’s performance. It is reviewed quarterly to ensure it accurately reflects the European stock market.

Performance and Importance

The STOXX Europe 600 Index is widely used by investors to gauge the performance of the European equity market. It serves as a benchmark for various investment funds, ETFs, and financial products. Analysts and investors closely monitor the index to understand market trends and make informed investment decisions.

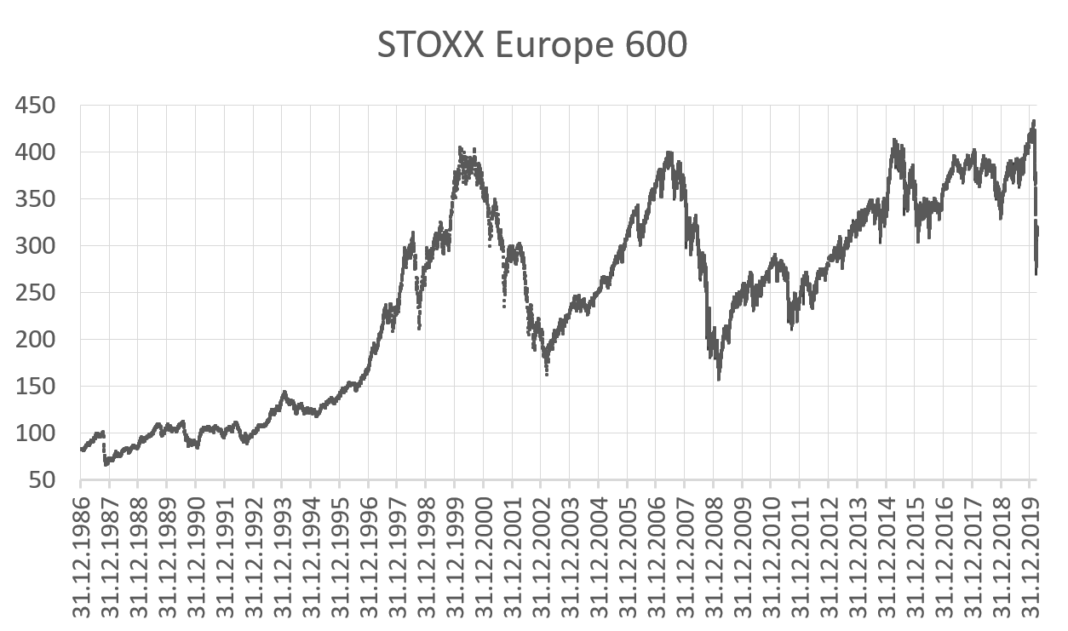

Historical Context

Since its inception, the STOXX Europe 600 Index has been a crucial indicator of European market health. It has weathered various economic cycles, including the dot-com bubble, the 2008 financial crisis, and more recent economic challenges. The index’s performance provides insights into the overall economic stability and growth prospects of Europe.

Investing in the SXXP Index

Investors can gain exposure to the STOXX Europe 600 Index through various financial instruments, including index funds and exchange-traded funds (ETFs). These products allow investors to invest in a diversified portfolio of European companies, spreading risk and potentially benefiting from the growth of the European economy.

Conclusion

The SXXP index is a vital tool for understanding the European stock market. It offers a comprehensive snapshot of the market’s performance, including a diverse range of companies from various sectors and countries. For investors looking to diversify their portfolios and gain exposure to European equities, the STOXX Europe 600 Index is an essential benchmark.