Outline

- Introduction

- Brief overview of Teleperformance SE

- Purpose of the analysis

- Recent Share Price Trends

- Current share price

- Overview of price fluctuations over the past year

- Key events impacting the share price

- Factors Influencing Teleperformance’s Share Price

- Global Economic Conditions

- Technological Advancements

- Earnings Reports

- Acquisitions and Partnerships

- Regulatory Environment

- Investment Considerations

- Financial Health

- Market Position

- Dividends

- Analyst Ratings

- Risks

- Conclusion

- Summary of Teleperformance’s market position and future outlook

- Key considerations for potential investors

- Additional Resources

- Links to financial news websites and stock trading platforms

- Call to action for visiting the GPT store page for more articles

Introduction

Teleperformance share price is a global leader in outsourced customer and citizen experience management, serving various industries and delivering a comprehensive range of services. This analysis explores the company’s share price trends, factors influencing its valuation, and what potential investors should consider.

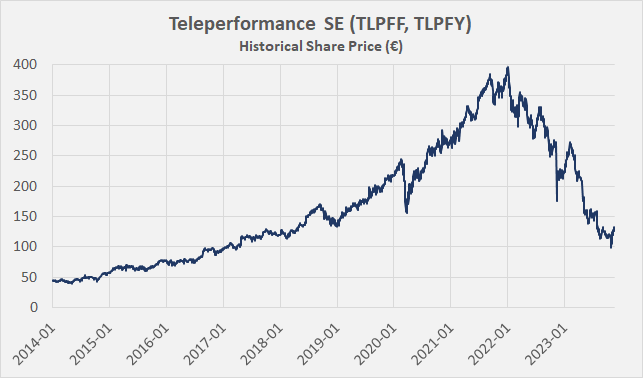

Recent Share Price Trends

As of [insert date], Teleperformance’s share price is [insert current price]. Over the past year, the stock has experienced fluctuations due to various market conditions and company-specific events. For instance, Teleperformance has been expanding its digital transformation services, which positively impacted its stock performance. However, economic uncertainties and global market trends have also played a role in influencing the share price.

Factors Influencing Teleperformance’s Share Price

- Global Economic Conditions: Teleperformance share price operates in numerous countries, and global economic conditions can significantly impact its share price. Economic downturns or geopolitical tensions can lead to market volatility.

- Technological Advancements: As a leader in customer experience management, Teleperformance invests heavily in technology. Innovations in AI and digital services can enhance its service offerings, potentially driving up the stock price.

- Earnings Reports: Quarterly and annual earnings reports are critical in influencing the share price. Positive earnings surprises typically lead to an increase in share price, while disappointing results can cause a decline.

- Acquisitions and Partnerships: Strategic acquisitions and partnerships can bolster Teleperformance’s market position and positively impact the stock price. Recent acquisitions have strengthened their global presence and diversified service portfolio.

- Regulatory Environment: Changes in regulations, especially in data protection and privacy, can affect Teleperformance’s operations and profitability, thereby influencing the stock price.

Investment Considerations

- Financial Health: Investors should review Teleperformance’s financial statements, focusing on revenue growth, profit margins, and debt levels. A strong financial position suggests stability and potential for growth.

- Market Position: Teleperformance’s leadership in the customer experience management industry and its global footprint make it a formidable player. Understanding its market position and competitive advantages is crucial for assessing long-term investment potential.

- Dividends: Teleperformance has a history of paying dividends. Investors seeking income may find this attractive, but it’s essential to evaluate the sustainability of these dividends.

- Analyst Ratings: Reviewing analyst ratings and price targets can provide insights into market sentiment and expectations for Teleperformance’s future performance.

- Risks: Potential risks include exposure to economic downturns, changes in consumer behavior, and regulatory challenges. Understanding these risks helps in making an informed investment decision.

Conclusion

Teleperformance share price is a significant player in the outsourced customer and citizen experience management industry, with a robust market position and a commitment to technological innovation. While its share price is influenced by various factors, careful analysis and consideration of the company’s financial health, market trends, and potential risks are essential for making informed investment decisions.

FAQs

- What is Teleperformance SE?

- Teleperformance SE is a global leader in outsourced customer and citizen experience management, offering a range of services across various industries.

- How has Teleperformance’s share price performed recently?

- As of [insert date], the share price is [insert current price]. The stock has experienced fluctuations over the past year due to various market conditions and company-specific events.

- What factors influence Teleperformance’s share price?

- Several factors, including global economic conditions, technological advancements, earnings reports, acquisitions, partnerships, and the regulatory environment, influence the share price.

- Is Teleperformance a good investment?

- Teleperformance has a strong market position and invests heavily in technology. Potential investors should consider the company’s financial health, market position, dividend history, analyst ratings, and associated risks before making an investment decision.

- What are the risks associated with investing in Teleperformance?

- Risks include exposure to economic downturns, changes in consumer behavior, regulatory challenges, and market volatility.