Outline

I. Introduction

- Brief overview of Vestas Wind Systems A/S

- Importance of Vestas in the renewable energy sector

- Purpose of the article

II. Company Overview

- History and background

- Core business activities (manufacturing, selling, installing, servicing wind turbines)

- Key markets and global presence

III. Current Stock Performance

- Recent stock price trends

- Key financial metrics (market capitalization, P/E ratio, dividend yield, 52-week range, volume)

- Analysis of recent performance

IV. Financial Health

- Recent quarterly and annual financial results

- Revenue, net income, profit margins

- Debt levels and liquidity

V. Growth Drivers

- Global demand for renewable energy

- Government policies and incentives

- Technological advancements in wind energy

- New projects and contracts

VI. Risks and Challenges

- Competitive landscape (key competitors)

- Regulatory and policy risks

- Economic fluctuations

- Operational challenges

VII. Future Outlook

- Industry trends and future prospects

- Company’s strategic plans and initiatives

- Analyst predictions and stock price forecasts

VIII. Conclusion

- Summary of key points

- Final thoughts on Vestas as an investment

Introduction

- Vestas Wind Systems A/S, commonly known as Vestas stock, is a Danish manufacturer, seller, installer, and servicer of wind turbines. Founded in 1945, Vestas has grown to become one of the largest and most recognized companies in the renewable energy sector.

-

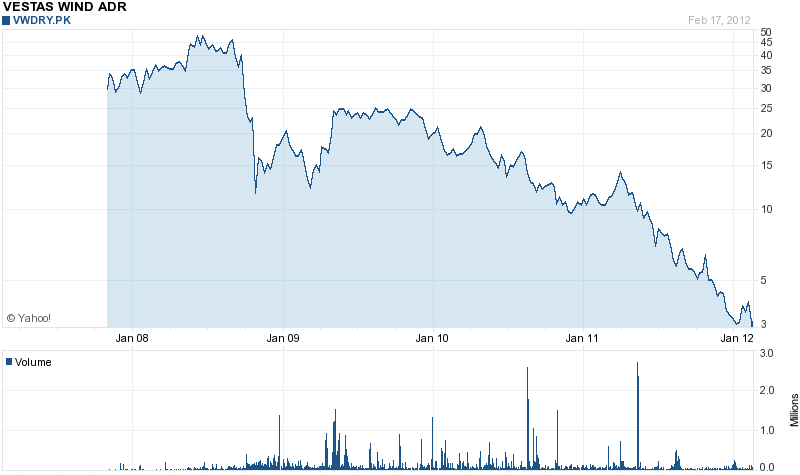

Current Stock Performance

- To get the most current and accurate stock performance data for Vestas (VWS.CO), it’s recommended to check financial news websites, stock market apps, or financial services platforms like Bloomberg, Yahoo Finance, or Reuters.

Key Metrics to Watch:

- Stock Price: The current price of the stock and its performance over various periods (daily, weekly, monthly, yearly).

- Market Capitalization: The total market value of the company’s outstanding shares.

- P/E Ratio: The price-to-earnings ratio, which helps evaluate the company’s current share price relative to its per-share earnings.

- Dividend Yield: The dividend per share, divided by the price per share.

- 52-Week Range: The highest and lowest prices at which the vestas stock has traded over the past year.

- Volume: The number of shares traded during a given period.

Recent Performance and News

- Financial Results: Keep an eye on the quarterly and annual financial results, which include revenue, net income, and profit margins.

- Projects and Orders: Announcements about new wind farm projects, contracts, and order backlogs can significantly impact stock performance.

- Industry Trends: The performance of the renewable energy sector, government policies, and global energy demand trends.

- Innovations and Technology: Advances in wind turbine technology and efficiency improvements.

Investment Considerations:

- Renewable Energy Growth: As global emphasis on renewable energy sources increases, companies like Vestas are positioned to benefit.

- Policy and Regulation: Government incentives for renewable energy can positively impact Vestas, while regulatory hurdles can pose risks.

- Competition: Monitor competitors like Siemens Gamesa, General Electric, and Nordex, among others, as their performance and innovations can influence Vestas’s market position.

- Global Market: Vestas’s presence in multiple regions helps mitigate risks associated with market dependence, but also exposes it to global economic fluctuations.

Conclusion

- Investing in Vestas stock offers exposure to the renewable energy sector, which is poised for growth in the coming years. However, it’s essential to conduct thorough research and consider various market factors before making investment decisions.

FAQs

1. What is Vestas Wind Systems A/S?

- Vestas Wind Systems A/S is a Danish company that designs, manufactures, installs, and services wind turbines globally. It is a leading player in the renewable energy sector.

2. Where is Vestas headquartered?

- Vestas is headquartered in Aarhus, Denmark.

3. How can I buy Vestas stock?

- Vestas stock can be purchased through stock exchanges where it is listed, such as the Copenhagen Stock Exchange (Ticker: VWS.CO). Investors can buy shares through brokerage accounts or trading platforms.

4. What factors influence Vestas’s stock price?

- Vestas’s stock price is influenced by its financial performance, new projects and contracts, government policies, global energy demand, and industry trends.

5. Does Vestas pay dividends?

- Yes, Vestas pays dividends. The dividend yield and payout can vary, so it’s important to check the latest financial reports or market data.